I am familiar with QuickBooks, Xero, and FreshBooks. These software programs are widely used for accounting tasks.

Financial management is made easier for firms by accounting software. For small to midsized enterprises, QuickBooks provides a wealth of capabilities. Cloud-based solutions are offered by Xero, enabling remote access. For independent contractors and small company owners, FreshBooks is a user-friendly platform. Since it meets various business needs, each software offers special advantages.

Inventory and payroll management are two areas where QuickBooks shines. Third-party applications are nicely integrated with Xero. Billing and spending management are made easier with FreshBooks. Based on your company’s needs, the best accounting software to use. Productivity is increased and reliable record-keeping is ensured through effective financial management. Maintaining compliance and financial stability is made easier for organisations when they are aware of these tools.

Introduction To Accounting Software

Accounting software has transformed how businesses handle financial tasks. It automates processes, reducing human error and saving time. Understanding different types of accounting software can help manage your business better. Let’s explore the role and evolution of these tools.

The Role Of Accounting Software

Accounting software plays a crucial role in modern business. It helps in tracking income and expenses, generating reports, and ensuring compliance with tax regulations. Here are some key functions:

- Bookkeeping: Automates recording of financial transactions.

- Invoicing: Creates and manages customer invoices.

- Payroll: Calculates employee wages and tax deductions.

- Financial Reporting: Generates detailed financial statements.

Evolution Of Accounting Tools

Over time, accounting tools have seen tremendous evolution. Originally, companies kept track of transactions using manual ledgers. This approach was laborious and prone to mistakes.

Excel and other spreadsheet programmes gained popularity with the introduction of computers. They improved the accuracy and speed of computations. However, they still needed data entry by hand.

We have specialised accounting software these days. These applications interface with other business systems and provide additional functionalities. They offer data and insights in real-time, assisting organisations in making wise decisions.

| Era | Tool | Features |

|---|---|---|

| Manual | Ledgers | Handwritten records, prone to errors |

| Early Digital | Spreadsheets | Automated calculations, manual data entry |

| Modern | Accounting Software | Automation, real-time data, integration |

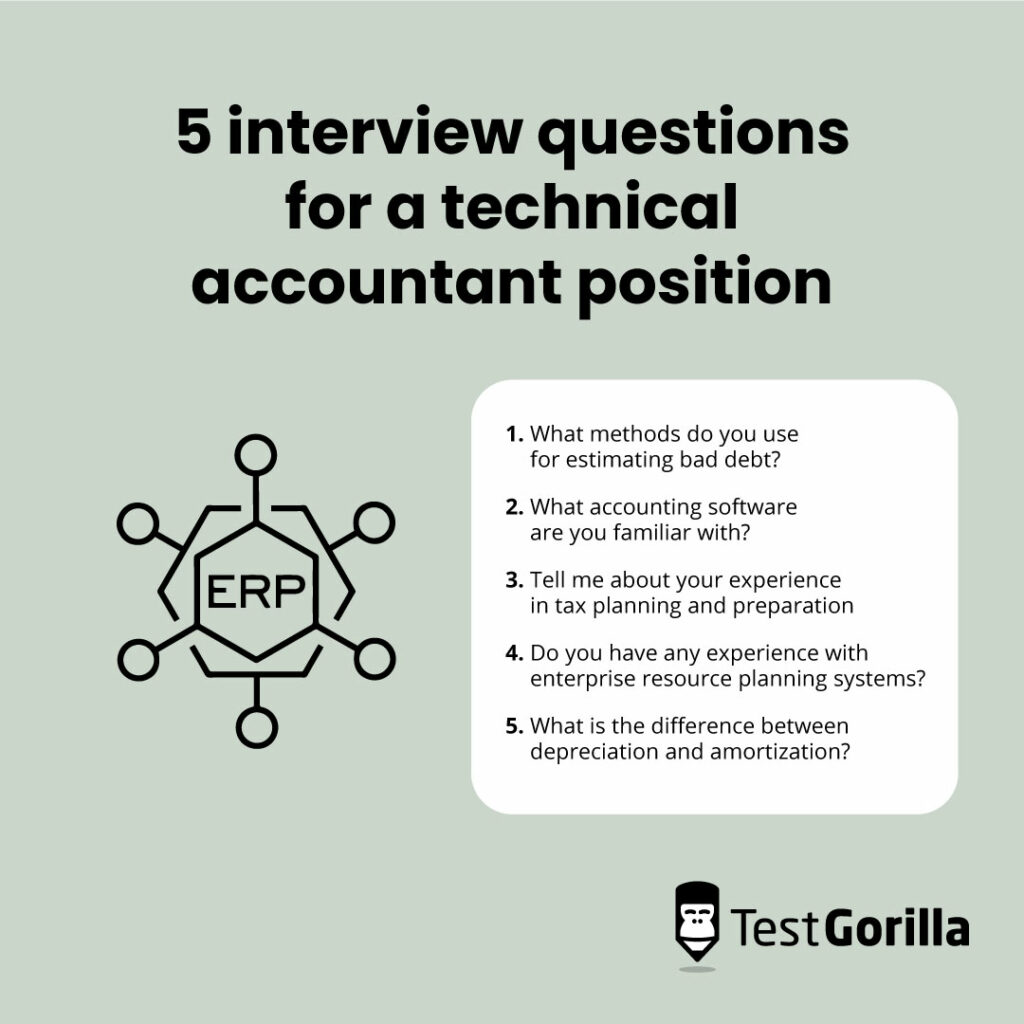

Credit: www.testgorilla.com

Various Categories Of Accounting Software

Accounting software comes in many forms. Each type serves different needs. Understanding these categories helps in choosing the right software. Let’s explore the various categories of accounting software.

Personal Vs. Business Accounting

Personal accounting software is for individual use. It helps manage personal finances. You can track expenses, create budgets, and monitor savings. Examples include Quicken and Mint.

Business accounting software is for companies. It handles more complex tasks. These include payroll, invoicing, and tax calculations. Examples are QuickBooks and FreshBooks.

Cloud-based Solutions

Cloud-based accounting software is accessible online. You can use it from any device with internet. This offers flexibility and convenience. Common features include real-time updates and multi-user access.

- QuickBooks Online

- Xero

- Wave

On-premises Software

On-premises software is installed on local computers. It offers more control over data. This type is often used by larger companies. It requires maintenance and updates manually.

| Software | Features |

|---|---|

| SAP | Complex financial management, integration with other systems |

| Oracle Financials | Advanced financial analysis, scalable for large businesses |

Choosing the right accounting software depends on your needs. Consider the size of your business and your specific requirements. This will help in making an informed decision.

Popular Accounting Software For Small Businesses

Small businesses need efficient accounting software. It helps manage finances easily. Choosing the right software can save time and reduce stress. Here are some popular accounting software programs for small businesses.

Quickbooks

QuickBooks is a favorite among small business owners. It offers a wide range of features. You can track income and expenses easily. It supports invoicing and payroll functions. QuickBooks also integrates with many third-party apps. This makes managing your business finances simple.

| Feature | QuickBooks |

|---|---|

| Income Tracking | Yes |

| Expense Tracking | Yes |

| Invoicing | Yes |

| Payroll | Yes |

| Third-Party Integrations | Yes |

Freshbooks

FreshBooks is another excellent choice. It is known for its user-friendly interface. FreshBooks excels in invoicing and expense tracking. It also offers time-tracking features. This is perfect for freelancers. FreshBooks provides detailed financial reports. This helps in understanding your business performance better.

- User-friendly interface

- Excellent invoicing features

- Expense tracking

- Time tracking

- Detailed financial reports

Xero

Xero is a powerful accounting tool. It is designed for small businesses. Xero supports multiple currencies. It makes international transactions easy. The software offers real-time financial data. This helps in making quick business decisions. Xero also integrates with over 800 apps. This ensures smooth operations.

- Multiple currency support

- Real-time financial data

- Over 800 app integrations

Top Picks For Medium To Large Enterprises

Medium to large enterprises require robust accounting software. These programs must handle complex financial tasks. They need to support multiple users and integrate with other systems. Below are the top accounting software picks for medium to large enterprises.

Sap Business One

SAP Business One is a powerful accounting tool. It’s designed for growing businesses. This software offers real-time accounting and financial management. It includes features like:

- Financial accounting

- Banking and reconciliation

- Fixed asset management

SAP Business One is also scalable. It can grow with your business needs. The software supports multiple currencies and languages. This makes it ideal for global operations.

Oracle Netsuite

Oracle NetSuite is an all-in-one business management suite. It offers a comprehensive accounting solution. Key features include:

- General ledger

- Accounts payable and receivable

- Tax management

Oracle NetSuite also provides advanced financial reporting. It integrates seamlessly with other NetSuite modules. This ensures smooth business operations across all departments.

Microsoft Dynamics Gp

Microsoft Dynamics GP is a flexible accounting software. It is part of the Microsoft Dynamics suite. Important features include:

- Financial management

- Inventory management

- Human resources and payroll

Microsoft Dynamics GP also offers powerful reporting tools. It integrates with other Microsoft products like Office 365. This enhances productivity and collaboration within your business.

Specialized Software For Niche Markets

In the world of accounting, different industries have unique needs. Specialized software for niche markets addresses these specific requirements. This allows businesses to manage finances more efficiently.

Construction Accounting Systems

Construction projects involve many complex tasks. Construction accounting systems help manage these activities.

- Job Costing: Track costs for each project separately.

- Progress Billing: Invoice clients based on project completion stages.

- Project Management: Plan and monitor project timelines and budgets.

These systems streamline financial management for construction businesses. This leads to better project control and increased profitability.

Nonprofit Accounting Software

Nonprofit organizations have unique financial needs. Nonprofit accounting software caters to these requirements.

- Fund Accounting: Track donations and grant money separately.

- Donor Management: Manage donor information and contributions.

- Compliance Reporting: Ensure adherence to regulatory requirements.

This software helps nonprofits maintain transparency. It also ensures proper fund allocation.

Specialized software for niche markets provides tailored solutions. This leads to more efficient financial management.

:max_bytes(150000):strip_icc()/computer-skills-list-2063738-Final-d30001660f21447aa6e14d29c21c6a83.png)

Credit: www.thebalancemoney.com

Open Source Accounting Tools

Open source accounting tools offer free and flexible software solutions. These tools are ideal for startups and small businesses. Let’s explore the benefits and popular options available.

Advantages Of Open Source

Open source accounting tools come with many advantages. Here are some key benefits:

- Cost-Effective: Most open source tools are free to use.

- Customization: Users can modify the software to fit their needs.

- Community Support: A large community offers help and updates.

- Transparency: Users can review and improve the source code.

- Security: Regular updates fix bugs and security issues.

Notable Open Source Platforms

Several open source accounting tools stand out. Here are some popular choices:

| Platform | Features |

|---|---|

| GnuCash |

|

| Odoo |

|

| Manager.io |

|

Each of these platforms offers unique features. Choosing the right one depends on your business needs.

Features To Consider When Choosing Software

Choosing the right accounting software is crucial for your business. The right software simplifies financial tasks, enhances accuracy, and supports growth. Let’s explore essential features to consider when picking accounting software.

Integration Capabilities

Integration capabilities are vital for seamless workflows. The software should connect with other business tools.

- CRM Systems: Synchronize customer data.

- Payroll Software: Automate employee payments.

- Banking Apps: Streamline bank transactions.

Ensure the software supports multiple integrations to save time and reduce errors.

Scalability

Scalability ensures the software grows with your business. Choose software that adapts to increasing data and users.

| Small Business | Medium Business | Large Enterprise |

|---|---|---|

| Basic features | Advanced reporting | Custom modules |

| Single user | Multiple users | Unlimited users |

This adaptability ensures long-term usability without frequent upgrades.

User Accessibility

User accessibility is crucial for efficient software use. The interface should be user-friendly and intuitive.

- Ease of Use: Simple navigation and clear instructions.

- Multi-Device Access: Availability on desktop, tablet, and mobile.

- User Permissions: Control access levels for different users.

Accessible software enhances productivity and reduces the learning curve.

The Future Of Accounting Software

The future of accounting software is bright. Technology is transforming how businesses handle their finances. From AI to mobile accounting, new tools are emerging. These tools make accounting faster and easier.

Ai And Automation

AI and automation are changing accounting. AI can handle repetitive tasks. This includes data entry and invoice processing. Automation reduces human error. It also saves time. Accountants can focus on more important tasks.

Machine learning is another key feature. It helps in predicting trends. It can also detect fraud early. This increases the security of financial data.

Predictive Analytics

Predictive analytics is the next big thing. It uses historical data to forecast future trends. This helps businesses make better decisions. For example, it can predict cash flow problems. Companies can take action before issues arise.

With predictive analytics, businesses can also plan for growth. It offers insights into customer behavior. This helps in creating better marketing strategies.

Mobile Accounting

Mobile accounting is on the rise. It offers flexibility. Accountants can access data from anywhere. This is especially useful for remote work. Mobile apps provide real-time updates. This keeps everyone on the same page.

Mobile accounting apps are user-friendly. They offer features like expense tracking and invoice management. This makes managing finances easier for small businesses.

| Feature | Benefit |

|---|---|

| AI and Automation | Reduces errors and saves time |

| Predictive Analytics | Helps in forecasting and decision-making |

| Mobile Accounting | Offers flexibility and real-time updates |

In summary, the future of accounting software is exciting. These new tools offer many benefits. They make accounting more efficient and secure.

Making The Right Decision

Choosing the correct accounting software is vital for business success. The right tool helps manage finances and ensures compliance. Below, we explore steps to make the best choice.

Evaluating Business Needs

First, understand your company’s unique requirements. List tasks like invoicing, payroll, and tax reporting. Different businesses have different needs. Identify key features you cannot miss.

- Invoicing: Do you need to send invoices often?

- Payroll Management: Do you handle employee payments?

- Tax Reporting: Is tax season a major focus?

Once you know your needs, you can narrow down options.

Software Trials

Many accounting software programs offer free trials. These trials let you test features and ease of use. During the trial period, perform essential tasks to see how the software handles them.

Here’s a simple checklist for testing:

- Set up a sample company profile.

- Create and send an invoice.

- Run a payroll cycle.

- Generate a basic financial report.

Use these tests to determine if the software meets your needs.

Consulting With Accountants

Consult with your accountant before making a decision. Accountants have experience with various software programs. They can offer valuable insights and recommendations.

Consider these questions:

- Which software do they prefer?

- What features do they find most useful?

- Are they familiar with the software’s support system?

Their input can guide you to the most efficient solution.

:max_bytes(150000):strip_icc()/accounting-interview-questions-2061424-Final-9c4a5e89e29547edae30c0f354ecb08b.png)

Credit: www.thebalancemoney.com

Frequently Asked Questions

What Accounting Software Are You Most Familiar With?

I am most familiar with QuickBooks, Xero, and FreshBooks. These platforms offer robust features for small to medium-sized businesses.

What Are The Different Types Of Accounting Software?

The different types of accounting software include cloud-based, desktop, enterprise, and small business solutions. Popular options are QuickBooks, Xero, and FreshBooks.

What Kind Of Software Do Accountants Use?

Accountants use software like QuickBooks, Xero, FreshBooks, and Sage. These tools help manage finances, track expenses, and generate reports.

What Is Accounting Software And Examples?

Accounting software manages financial transactions and records. Examples include QuickBooks, Xero, and FreshBooks. These tools streamline bookkeeping, invoicing, and financial reporting.

Conclusion

Choosing the right accounting software can streamline your business operations. Familiarize yourself with various options to make an informed decision. Each software has unique features tailored to different needs. Evaluate your business requirements carefully. The right choice can significantly impact your financial management and overall success.

Leave a Reply